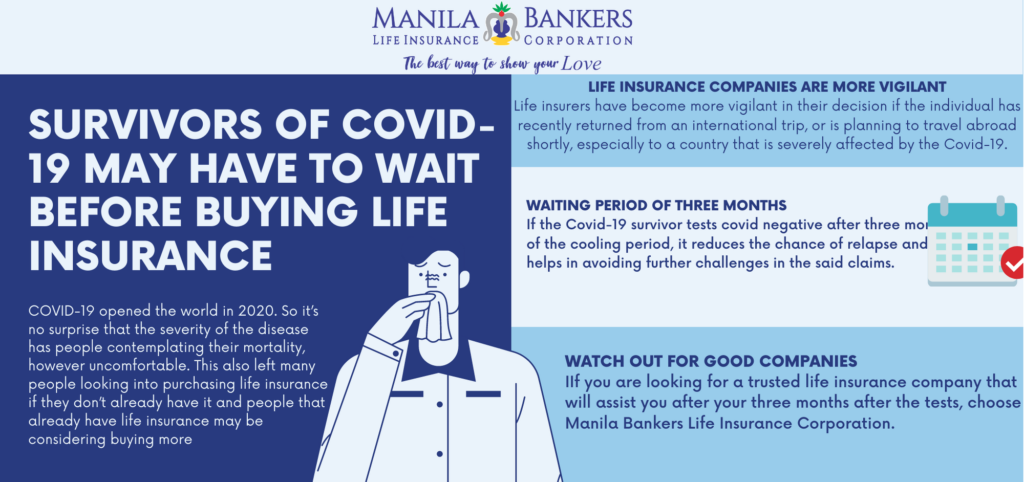

SURVIVORS OF COVID-19 MAY HAVE TO WAIT BEFORE BUYING LIFE INSURANCE

COVID-19 opened the world in 2020. So it’s no surprise that the severity of the disease has people contemplating their mortality. This also left many people looking into purchasing life insurance if they don’t already have it, and people that already have life insurance may be considering buying more.

Unfortunately, many of the people who are Covid-19 survivors might not have an insurance policy or have inadequate insurance. These people may now want to buy a new insurance cover. However, Covid-19 survivors experiencing health issues will have to undergo medical tests and wait up to three months before they can buy a life insurance policy. Many insurers have imposed a three-month waiting period before issuing a policy to Covid-19 survivors.

Life insurers have also become more vigilant in their decision if the individual has recently returned from an international trip, or is planning to travel abroad shortly, especially to a country that is severely affected by the Covid-19.

Life insurance claims are often denied due to pre-existing medical conditions, family medical history, hazardous occupation, risky lifestyle choices, or provision of fraudulent documents at the time of policy application. If a policyholder does not provide the right information, the life insurance can also be rejected by the insurer. Thus, in the case of Covid 19, the insurer might request additional medical tests as well to identify the risk category of the applicant as life insurance contracts are solicited truthfully or issued in utmost good faith.

A Covid-19 survivor will get life cover but with a waiting period of one to three months or more, depending on the severity of the infection and where the subject is prevalent underwriting.

This clause requires the individual to disclose all material facts in the proposal form, including pre-existing medical conditions. So if you are a Covid-19 survivor, life insurance can be offered post three months of the medical examiner’s sign-off.

It has become difficult for Covid-19 survivors to buy life insurance because many insurance companies require a cooling off or waiting period. If the Covid-19 survivor tests covid negative after three months of the cooling period, it reduces the chance of relapse and helps in avoiding further challenges in the said claims.

The quantum of compensation in a life insurance policy is usually a significant amount. If the insurance company accepts too many such risky policies, it may become challenging for it to honor the claims later if a large number of people get affected due to post covid medical complications.

The requirement for a medical test while buying life insurance is not new especially when it comes to high-risk cases. However, insurers have become extra cautious and testing more widely and thoroughly, it completely depends on the insurance companies.

Now, that you have a grasp of the truth about COVID survivor’s life insurance policies and if you are looking for a trusted life insurance company that will assist you after your three months after the tests, choose Manila Bankers Life Insurance Corporation.

Manila Bankers Life Insurance Corporation has been around since 1967. It is a life insurance company duly recognized and authorized by the Philippine Insurance Commission. The company creates customized life insurance packages based on the requirements of its major and significant customers. They are equipped with the friendliest and most helpful life insurance agents to help you figure out what plan best suits your needs.