IS PREMIUM OF LIFE INSURANCE WORTH IT?

Buying life insurance is one of the most important financial decisions, but believe it or not, here in the Philippines only a few Filipinos are insured. If you wonder why? This is because a lot of them don’t give it enough value. So why is it so important? Well, regardless of how much you earn, no one knows what the future holds.

It can be quite confusing in terms of the language of life insurance. Being fluent in life insurance requires some patience, but if there is one term to get extra familiar with, it’s “premium”. This word has everything to do with what you’ll pay to keep your coverage in place. Life insurance has its own language. Words life beneficiary, rider, and underwriting come up frequently when you’re shopping for life insurance coverage and after a while, the terms can start running together.

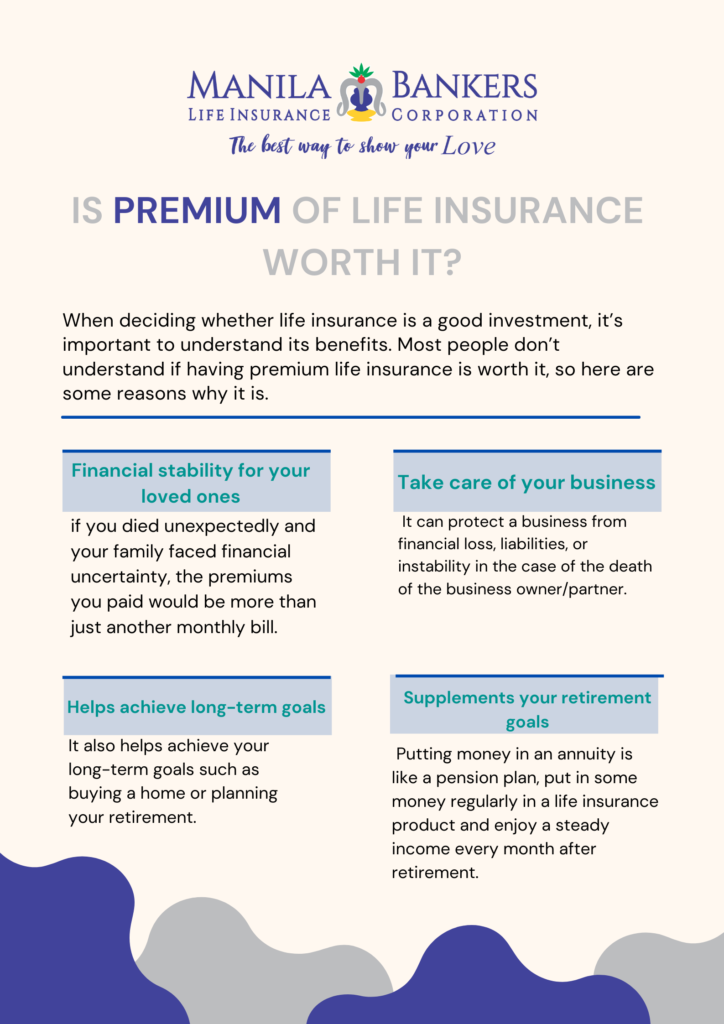

To simply understand having a premium life insurance investment here in the Philippines, simply put premium means a payment. It’s the amount of money you pay your life insurance company in exchange for your coverage. Calculating a premium can seem a little mysterious. When deciding whether life insurance is a good investment, it’s important to understand its benefits. Most people don’t understand if having premium life insurance is worth it, so here are some reasons why it is.

Financial stability for your loved ones

A life insurance premium in the Philippines is a payment, just like the mortgage, the utilities, the student loans, and the Netflix. But if you died unexpectedly and your family faced financial uncertainty, the premiums you paid would be more than just another monthly bill. They’d offer a doorway to financial stability for your loved ones.

Take care of your business

This 2021, a life insurance premium isn’t just for individuals. It can protect a business from financial loss, liabilities, or instability in the case of the death of the business owner/partner. Whether providing necessary short-term cash keeping operations going until things settle, life insurance can be valuable in maintaining the business you’ve worked so hard to build.

Helps achieve long-term goals

Since having life insurance in the Philippines is important in 2021, it also helps achieve your long-term goals such as buying a home or planning your retirement. It also provides you with diverse investment options that come along with different types of policies. Some policies are tied to certain investment products that pay dividends based on their performance.

Supplements your retirement goals

Who wouldn’t like their retirement savings to last until they do? With a life insurance plan, you can ensure you can have a regular stream of income every month. Putting money in an annuity is like a pension plan, put in some money regularly in a life insurance product and enjoy a steady income every month after retirement.

Shop around and determine your actual life insurance needs, lock in a term life rate that takes advantage of your current youth and good health. Each time you make a premium payment, you’ll know it is going to financially protect your loved ones. Definitely a good and worthy investment! This 2021 a good place to start if you are located in the Philippines is Manila Bankers Life Insurance Corporation. One of the longest-standing insurance companies in today’s market that have been around since 1967.