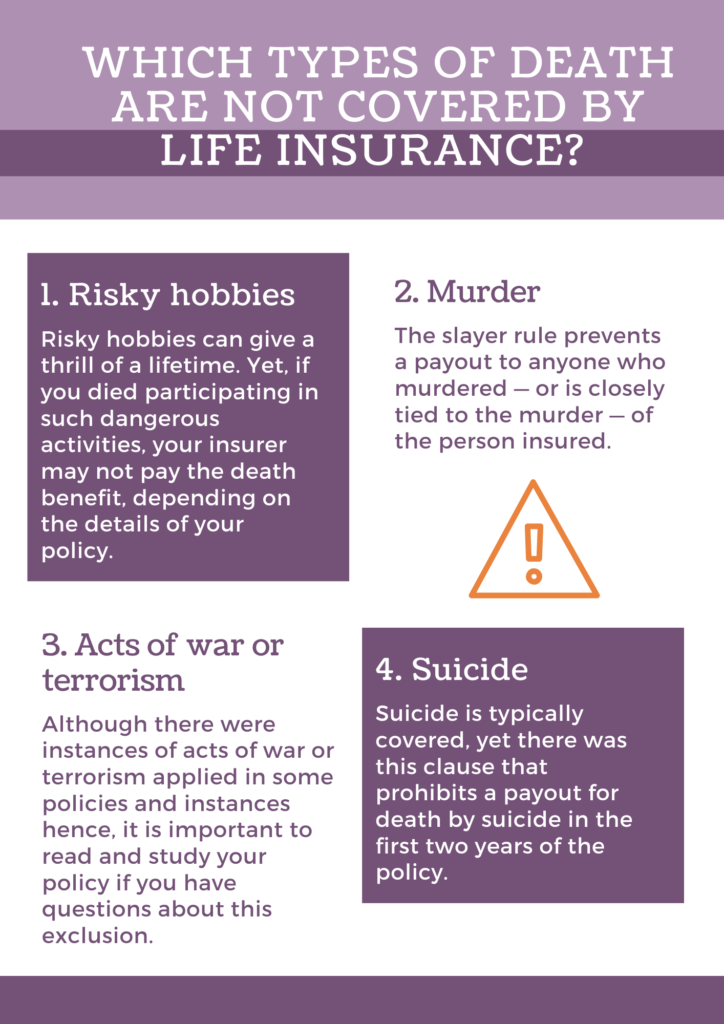

Which types of Death are not covered by Life Insurance?

Manila Bankers Life insurance can help you be covered and protected from the unexpected. Yet if we look at the fine print, you would be surprised that there were exemptions, conditions, and prohibitions that you have to be more mindful of.

There were in fact types of death that are not covered by life insurance that you should be aware of to save you from the hassle.

1. Risky hobbies

Risky hobbies can give a thrill of a lifetime. Yet, if you died participating in such dangerous activities, your insurer may not pay the death benefit, depending on the details of your policy. In such cases, your insurer may add an exclusion to your policy that prohibits payment if you die doing the said risky activity.

2. Murder

Unfortunately, there is this rule that makes murder not covered by insurance – the slayer rule. The slayer rule prevents a payout to anyone who murdered — or is closely tied to the murder — of the person insured. Deaths from illegal activity may be excluded from your policy, too. This varies by insurer, so check your policy for details.

3. Acts of war or terrorism

There were insurance companies that would include an exclusion in their policies for deaths caused by war or terrorism. It’s less common to see this exclusion in life insurance than in other types of insurance, however. Although there were instances of acts of war or terrorism applied in some policies and instances hence, it is important to read and study your policy if you have questions about this exclusion.

4. Suicide

Suicide is a very sensitive case, especially in these times where mental health is now at the front and center of the conversation. Suicide is typically covered, yet there was this clause that prohibits a payout for death by suicide in the first two years of the policy.

Sinasabi ko sa iyo, hindi ko alam kung ano ang gagawin ko kung wala ang aking Manila bankers life insurance policy.

Napakahirap na mawalan ng aking asawa – husband, ang kumpanya nag padali para ma protektahan ang aking pamilya.

Nakakuha ako kaagad ng coverage, at hindi ko na kailangang harapin ang lahat ng mga papeles sa aking sarili. Inalagaan ng kumpanya ang lahat!